An ounce of information

.jpg)

Article by Pnut King

Published on 03/03/2023 in Peanut Market News

Explore the global consumption of peanuts & its fluctuating prices in recent years. Discover whether the demand for this beloved nut can continue to meet the pace of its popularity

Peanuts are produced, manufactured, and consumed in large quantities by people all over the world. Whether as peanut butter, chilli-flavoured snacks, as oil, or in cakes, bakes, or brownies, they’re fast becoming one of the most popular ingredients around. Even conservative estimates expect global cultivation to hit 68 million tons by 2050, according to the UN’s Food and Agriculture Organization.

But with plenty of other nuts to choose from and new peanut products hitting the market such as cold-pressed peanut oil and refined flours, how has consumption changed in recent years? And, crucially, what impact has that had on global prices for farmers, manufacturers, traders, and consumers?

In this article, we’ll take a look at the macroeconomic factors that have triggered significant changes in the peanut trade, explore how they relate to other nuts, seeds, and derivative oils, and take a view as to the relationship between peanut prices and peanut consumption. As we’ll discover, all is not as it seems.

Let’s crack on.

Money money money: What’s been happening in peanut price trends around the world?

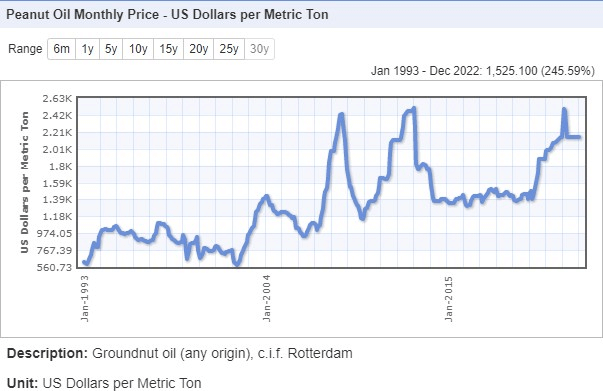

In 2022, many expected peanut prices to fluctuate dramatically, given the impact of numerous global economic shocks and our continued recovery from the COVID-19 pandemic. However, that was not the case, and global peanut prices have instead remained remarkably stable. In part, this is thanks to rising global production that has kept the market well supplied. Indeed, the average Runner peanut seed price on the key Rotterdam exchange (CIF; US Runners 40/50%, shelled basis) amounted to $1,525 per ton in January 2022. This is almost identical to the price a year earlier in January 2021.

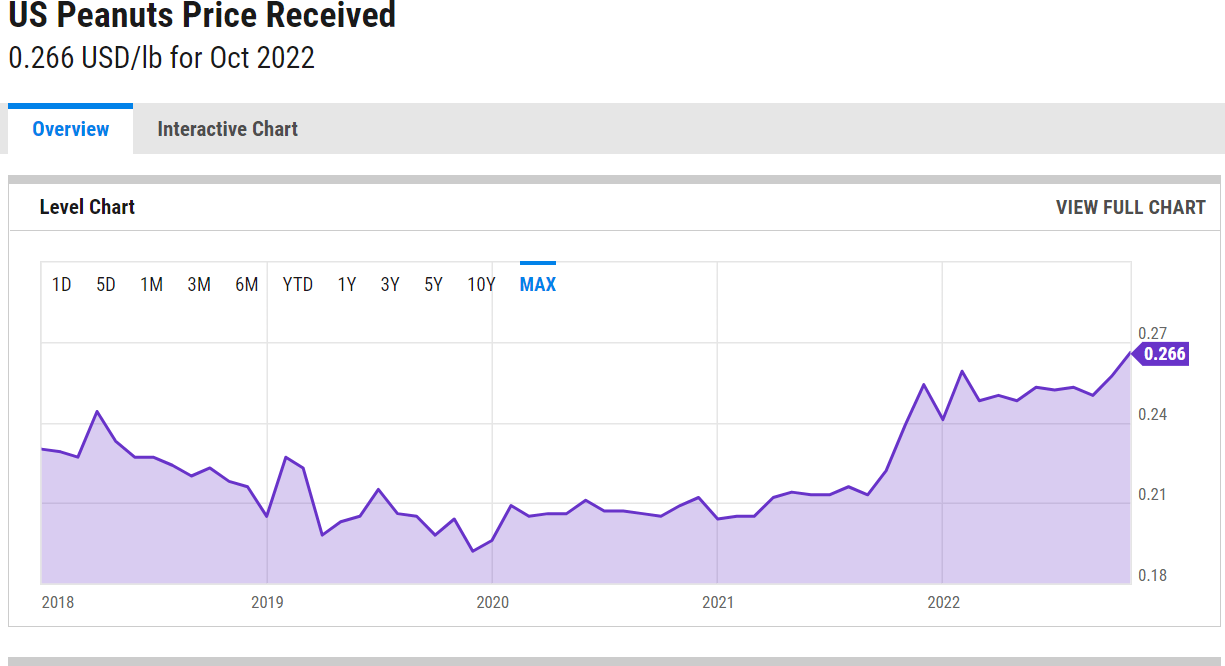

[Suggested graphic: peanut price received graph, example below from source:]

Generally speaking, peanut prices have risen fairly steadily over the past three decades, despite the impact of a few periods of more dramatic economic fluctuations.

Demand for key peanut products has also shown a healthy overall trend of growth, with similar shock price rises in 2008 and 2012, but later recovering to a more nominal rate of growth. By the end of 2022, the baseline price for peanut oil on the Rotterdam exchange was $2,150 per metric ton.

Peanut consumption over the years

Our global appetite for peanuts also shows little sign of diminishing, with consumption on the rise in most of the world. This year, the world’s peanut seed output is set to reach a record 50.7 million tonnes, increasing by 2.3% year on year. Global peanut import volumes grew by an astonishing 12% between 2017-2021, fuelled by an abnormally large 58% import increase in China over that period.

Over the same period, Argentinian exports grew by a massive 52%, representing 19.4% of total global peanut exports. India followed a close second in 2021 with 16.3% of global peanut exports, followed by the US on 11.6% and Sudan on 11.5%.

In total, 4,414,927 thousand dollars’ worth of peanuts were imported globally in 2021, up from 937,169 thousand dollars in 2002 and 2,936,889 thousand US dollars in 2012. In just two decades, that’s a significant increase in spending on peanut-related products.

The years affected by the COVID-19 pandemic unsurprisingly showed significant variation in import and export trends. The US, for example, registered a 41% increase in exports between 2019-20, immediately followed by a 29% decline in exports between 2020-21.

Similarly, US imports grew by 10% between 2019-20 and then fell by 57% between 2020-21, reflecting a switched focus on domestic production and consumption during those years – and a pulling away from the international market.

Whilst China similarly experienced a significant shift, much of which can be attributed to its COVID-19 recovery and the return of trade balances to a more normal position, in truth increased Chinese imports do reflect a rapidly accelerating trend over the past few years.

More recently, US peanut production has dropped in the past year, with the 639,490 hectares planted in 2021 falling to 590,480. This fall, however, reflects similar annual variation across oilseeds and nuts in general.

Competing nuts and their price and consumption trends

When compared with other nuts and oilseeds, peanut prices are thrown into a stark new light.

The price of US soybeans, for example, has risen much more dramatically, experiencing a threefold price rise over a similar period.

More than 90 million acres’ worth of soybeans were planted in 2017, and in 2018 acres of soybeans in the US exceeded corn acres for the first time since 1983. Although planted soybean acres decreased back to 76.1 million in 2019, they remain a heavy focus for US farmers and growers – fuelled by price rises and increased demand.

Peanut planting is also on the rise, and has typically grown in far larger quantities than more expensive snacking nuts. Last year for example (as of December 2022), 1,420,971 acres’ worth of peanuts were planted in the US, compared with 418,813 acres’ worth of almonds and 165,312 acres’ worth of pistachios.

Drought and insect damage has had a major impact on almond prices. In 2021, for example, prices in the US skyrocketed from $3,340 per metric ton in the first quarter to $4,450 per metric in the third quarter of the year. That’s an incredible 33% price rise. Although prices have since recovered somewhat, it’s clear that competitor nuts still attract premium pricing.

A versatile nut: Changing uses for peanuts

Peanuts are on the move. Over the last few years and decades their use has diversified and they’ve been incorporated into more snack products, processed in new and innovative ways, and used for more types of bird and animal feed.

These changes have, in part, been driven by their ability to help prevent heart disease and lower cholesterol. In fact, peanuts’ health benefits match more expensive nuts such as almonds. A study published in JAMA Internal Medicine found that those in a group of 72,000 mostly low-income Americans aged 40 to 79 who regularly ate peanuts were 21% less likely to have died of any cause over a period of about five years. In a group of 135,000 men and women in Shanghai, China aged 40 to 74, who were followed for six to 12 years, the death rate in peanut-eaters was 17% lower.

As a low-glycemic food, peanuts also won’t cause a spike in the consumer’s blood sugar levels, and they’ve been found to help lower the risk of type 2 diabetes in women. They’re rich in protein, unsaturated “good” fat (12 of the 14g of fat per serving), and fibre, and contain important nutrients such as magnesium, folate, vitamin E, copper, and arginine.

Protein-rich peanut flour is becoming increasingly popular, and its use in salty, spicy, and sweet snacks is all too well documented. As one of the world’s largest consumers, the US market provides the ideal example: Today, the average American eats six pounds of peanuts a year on average, and 50% of those are in the form of peanut butter.

Generic inflation: Evolving economies

How much can we account for changing nut prices based on broader economic trends?

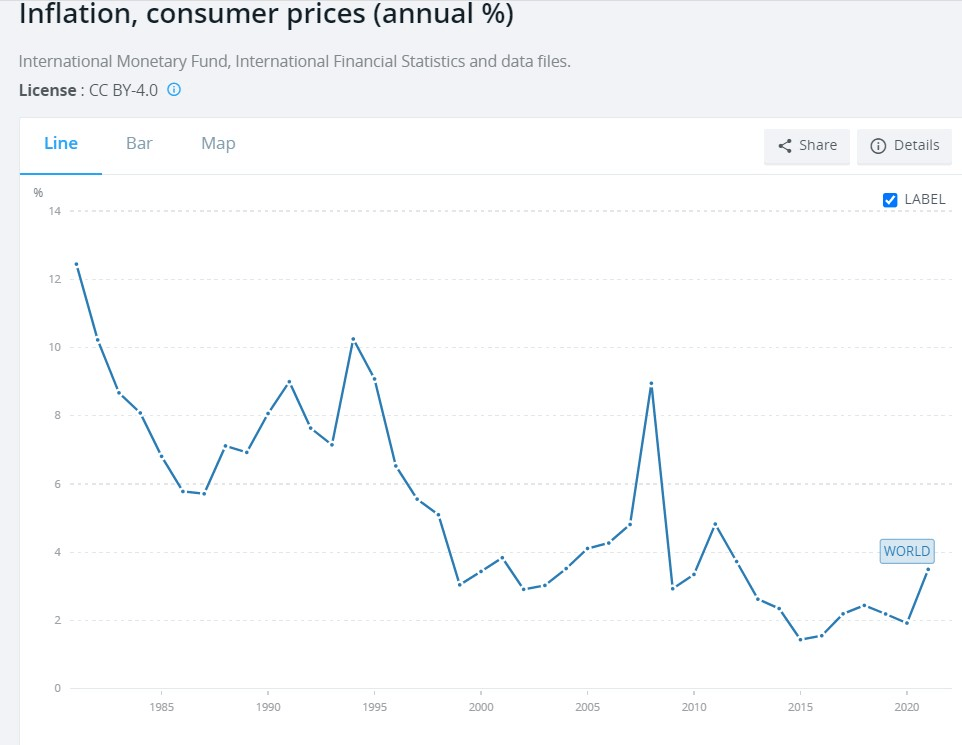

According to the World Bank, global inflation rates for consumer prices have fluctuated between a low of 1.5% and a high of 10.2% over the past 40 years. Particular economic shocks have occurred in 1982, 1991, 1994, and 2008, with 2022/23 likely to follow a similar pattern.

These effects have of course been largely mirrored in the peanut trade, with periods of low availability of money particularly pronounced for producers and manufacturers. When you put these figures alongside peanut prices, you can see that, by and large, things have remained stable – making peanuts one of the most affordable and accessible nut commodities around.

Per capita income trends

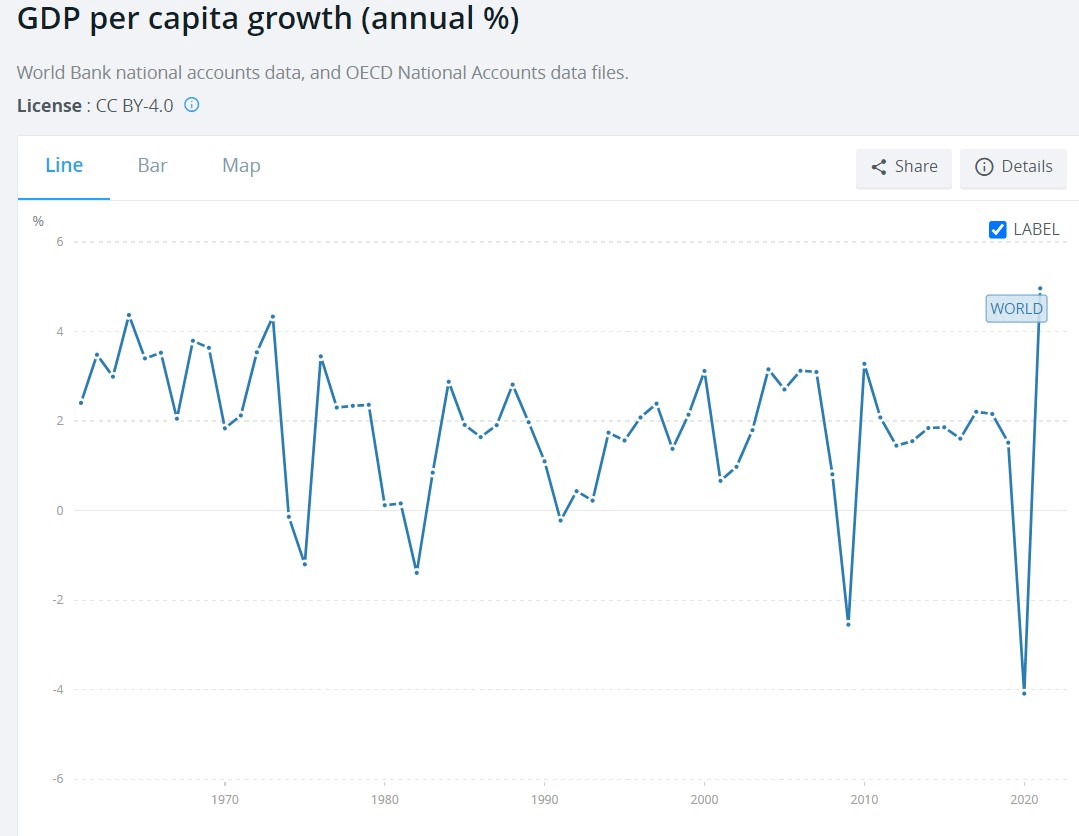

Gross domestic product per capita growth has proved far more volatile than inflation over the past 40 years. The World Bank reports a -2.5% hit during 2009 as the world recovered from the economic crash, offset by income growth around and above 3% in numerous subsequent years, when anomalies driven by the COVID-19 pandemic are excluded.

When income grows, so does consumer spending power, and the appetite for peanuts and all of their versatile products. Again, peanuts have remained a highly affordable route to significant health and dietary benefits, in addition to being a tasty and delicious snack.

Conclusion: What does this mean for the peanut trade?

Peanut prices have clearly been rising globally, and at a steady rate when averaged out over the past few decades.

However, when you put this data alongside changes in inflation and per capita spending power, and compare it with the rapid price increases experienced by a number of other nut categories, we can see that in relative terms peanut prices have remained remarkably stable.

With production and demand rising throughout that period, we can conclude that peanut pricing is not as closely linked to consumption as you might think.

Given the relatively high expense required for other nuts, and when you factor in the vastly versatile roles performed by the peanut, as well as its uniqueness, peanuts have never been such good value.

As a result, there are wide-ranging opportunities in the global peanut market for snack food manufacturers, growers, traders, and export promoters to deal in high-quality,

precision ingredients with the right chemistry, origin, and value proposition for a diverse range of needs. The outcome? A better product for the final consumer, and a better industry for all.

To find out more about how Agrocrops brings together the latest peanut science,

deep-rooted expertise, and a truly global enterprise to plant a stronger peanut future for everyone, get in touch.

With over 17 years of experience in the peanut industry and numerous awards recognising his contributions, he founded Agrocrops in 2008, a leading global peanut company. His passion for peanuts drives his commitment to improving the industry for all stakeholders and promoting sustainability.

.jpg)

Published on 03/04/2024 in

Published on 02/04/2024 in

Published on 22/03/2024 in

Published on 18/03/2024 in

Published on 03/03/2023

Published on 02/27/2023

Published on 02/18/2023

Published on 02/15/2023